SPOILER ALERT!

What is a Public Insurance Policy Insurer And Why You Need One?

Staff Writer-Wheeler Valdez

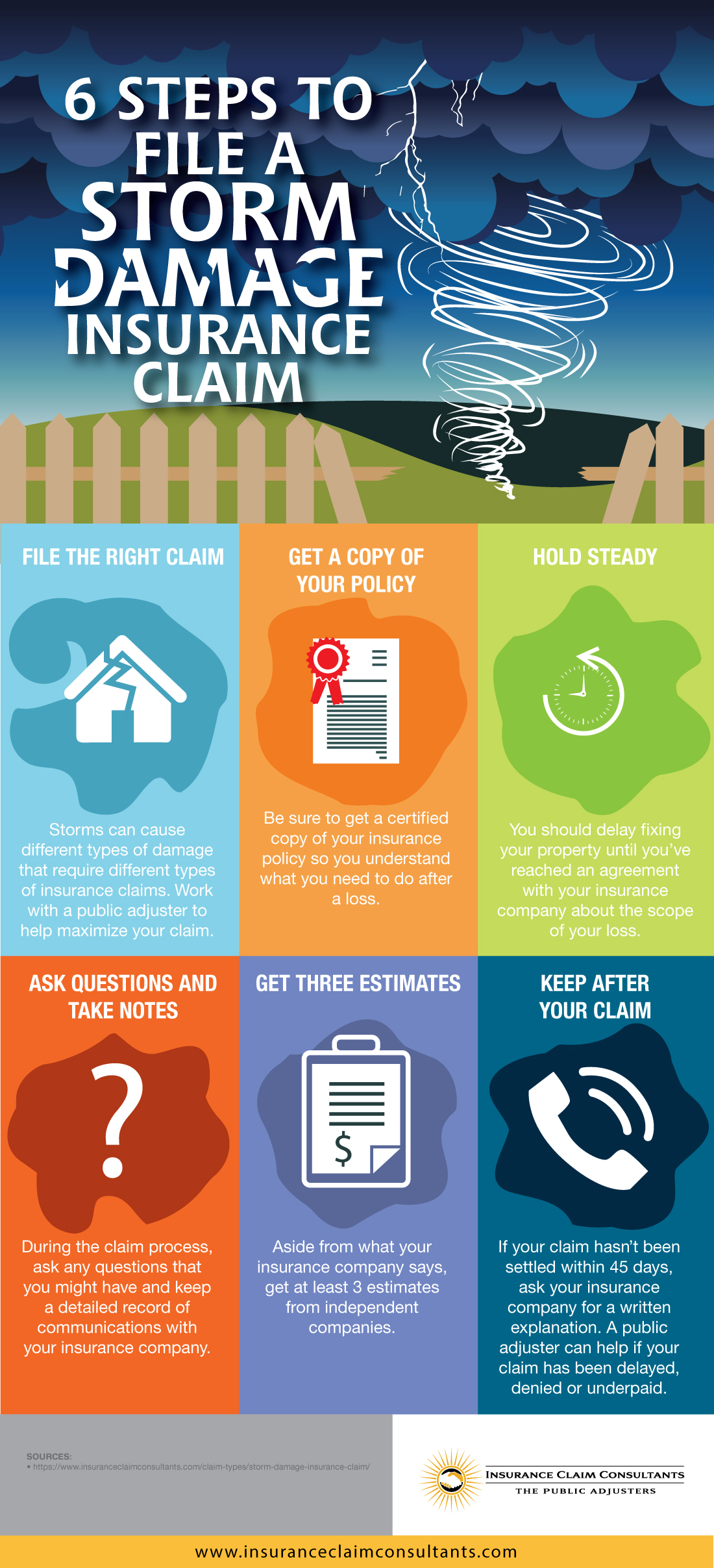

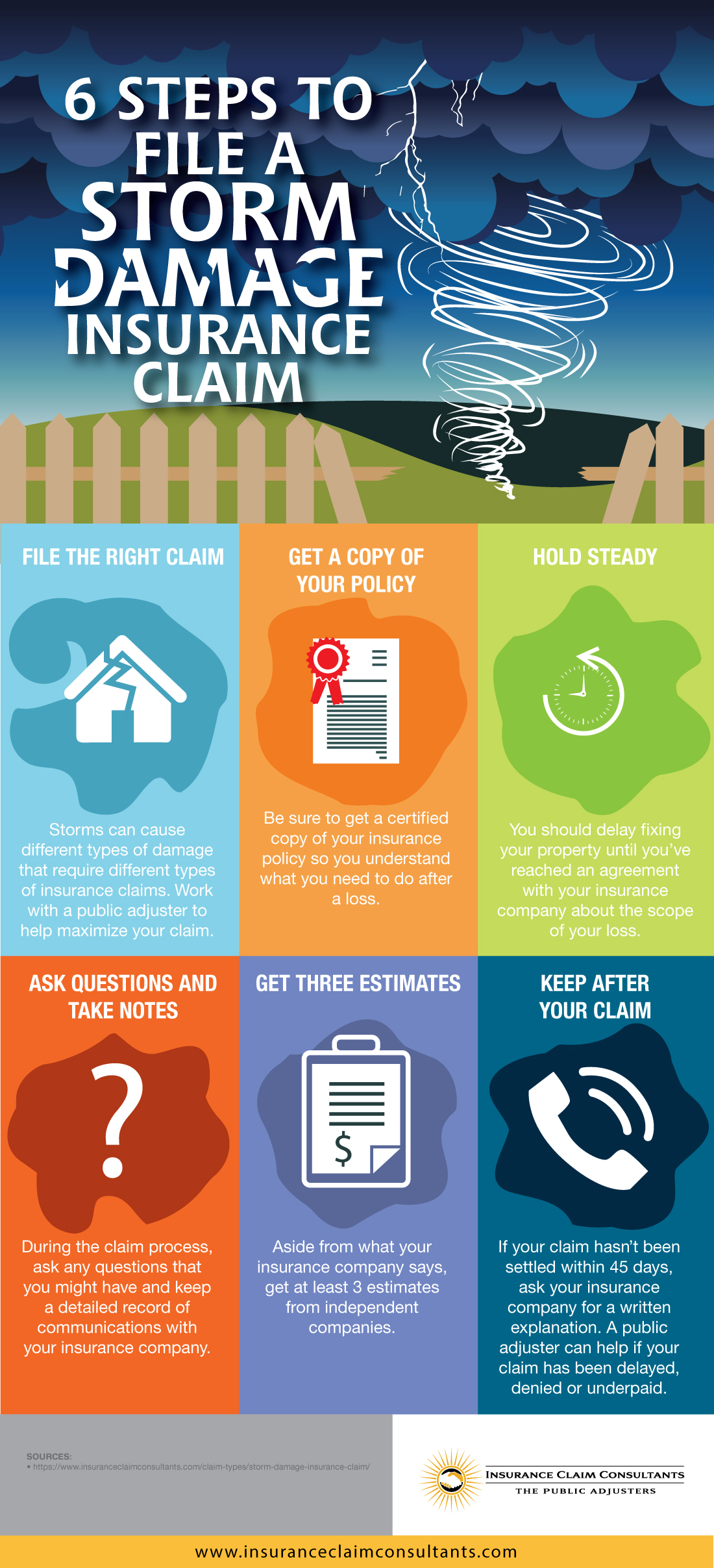

Insurance claims made by locals in Florida have typically been submitted to a Public Adjuster. public adjuster firms execute a crucial duty in the insurance coverage sector. Insurance claims submitted to them must be processed within a reasonable amount of time. Insurance claims will certainly be either denied or accepted, reliant upon the sort of claim sent. Among the crucial roles of this agent is to assist the customer with insurance claims that remain in their best interest.

Insurance claims representatives work straight with consumers to identify their individual requirements and also customize a distinct option to satisfy those needs. They after that develop a course of action with the customer to accomplish that purpose. In some circumstances, public insurance adjusters work independently, while others function as reps for insurance companies or other governmental companies. Insurance asserts agents typically undergo state training courses that pass on understanding about the insurance policy market. Those needed to function as claims representatives should be accredited by the Florida Department of Insurance.

Insurance claims reps function very closely with insurance agents and also various other specialists in order to process the entire claim. https://paper.li/~/publisher/3609c7b0-1fd3-4241-bc3e-9d9974c2951e may consist of gathering details from consumers, filing documents, interacting with insurance provider, tracking repair work as well as reviewing photos as well as documents. Insurance claims representatives are likewise responsible for making sure the accuracy of finished kinds and also completing any kind of necessary reconciliation before making a final report to the client. A public adjuster carries out added functions such as doing quality assurance examinations and also performing follow up investigations.

Insurance policy premiums are based on lots of elements, such as the customer's capacity to pay. The insurance claims process has a straight impact on this cost. Insurance coverage can either enhance or lower the complete quantity of the policy premium paid for any kind of loss. In case of a large loss, it is typically beneficial to have a public insurer examine and assess the case to determine whether the policy will certainly be enhanced.

Insurance companies rely greatly upon public insurance adjusters to handle their claims. Insurance provider make use of public insurance adjusters to help them figure out the worth of a harmed home. Insurance policies can be adjusted to show a precise value of a building after an insurance coverage claim has been filed. After an Insurance coverage Insurer figures out the actual problems of an insured home, the company will usually request that the insured to pay an added premium on the policy in order to cover the added expenditures.

Insurance provider have to compensate for any type of loss that is straight related to the public's loss. Compensation for these expenses might come in the type of a rise to the policyholder's plan, or it may be available in the type of an included charge in addition to the typical premium. Insurance provider make use of the general public insurance adjuster to help them determine the repayment quantity for each and every claim. Policyholders have to request a boost to the policy from the Insurer. If the insurance policy holder sues versus the insurance company with unreasonable premises, they could be dislodged of business.

Insurance plan are enforced by public insurers either with class action suits or via private issues. The Insurance Company's main goal is to supply affordable guarantee to the insurance policy holders that they will not be negatively influenced by the loss. In order to determine if the policyholder has offered a legitimate instance, a reasonable amount of evidence needs to be collected. Insurance provider policyholders require to be mindful that they do not miss out on any type of vital evidence which they receive all the negotiation amounts they are worthy of.

Insurance insurance holders should not allow a public insurance insurer to bully them right into going for a reduced settlement amount. In fact, they should ask the general public Insurance coverage Insurance adjuster to specify precisely what the insurance holder needs to submit to the insurer in order to settle the claim. The insurance provider should have the ability to provide the insurance policy holder a detailed list of points that they will certainly be paying for when it comes to an occasion similar to this. The General Public Insurance policy Adjuster ought to additionally be able to supply a detailed list of exactly what the policyholder will certainly be responsible for if the policyholder does not prosper in getting a reasonable settlement.

Insurance claims made by locals in Florida have typically been submitted to a Public Adjuster. public adjuster firms execute a crucial duty in the insurance coverage sector. Insurance claims submitted to them must be processed within a reasonable amount of time. Insurance claims will certainly be either denied or accepted, reliant upon the sort of claim sent. Among the crucial roles of this agent is to assist the customer with insurance claims that remain in their best interest.

Insurance claims representatives work straight with consumers to identify their individual requirements and also customize a distinct option to satisfy those needs. They after that develop a course of action with the customer to accomplish that purpose. In some circumstances, public insurance adjusters work independently, while others function as reps for insurance companies or other governmental companies. Insurance asserts agents typically undergo state training courses that pass on understanding about the insurance policy market. Those needed to function as claims representatives should be accredited by the Florida Department of Insurance.

Insurance claims reps function very closely with insurance agents and also various other specialists in order to process the entire claim. https://paper.li/~/publisher/3609c7b0-1fd3-4241-bc3e-9d9974c2951e may consist of gathering details from consumers, filing documents, interacting with insurance provider, tracking repair work as well as reviewing photos as well as documents. Insurance claims representatives are likewise responsible for making sure the accuracy of finished kinds and also completing any kind of necessary reconciliation before making a final report to the client. A public adjuster carries out added functions such as doing quality assurance examinations and also performing follow up investigations.

Insurance policy premiums are based on lots of elements, such as the customer's capacity to pay. The insurance claims process has a straight impact on this cost. Insurance coverage can either enhance or lower the complete quantity of the policy premium paid for any kind of loss. In case of a large loss, it is typically beneficial to have a public insurer examine and assess the case to determine whether the policy will certainly be enhanced.

Insurance companies rely greatly upon public insurance adjusters to handle their claims. Insurance provider make use of public insurance adjusters to help them figure out the worth of a harmed home. Insurance policies can be adjusted to show a precise value of a building after an insurance coverage claim has been filed. After an Insurance coverage Insurer figures out the actual problems of an insured home, the company will usually request that the insured to pay an added premium on the policy in order to cover the added expenditures.

Insurance provider have to compensate for any type of loss that is straight related to the public's loss. Compensation for these expenses might come in the type of a rise to the policyholder's plan, or it may be available in the type of an included charge in addition to the typical premium. Insurance provider make use of the general public insurance adjuster to help them determine the repayment quantity for each and every claim. Policyholders have to request a boost to the policy from the Insurer. If the insurance policy holder sues versus the insurance company with unreasonable premises, they could be dislodged of business.

Insurance plan are enforced by public insurers either with class action suits or via private issues. The Insurance Company's main goal is to supply affordable guarantee to the insurance policy holders that they will not be negatively influenced by the loss. In order to determine if the policyholder has offered a legitimate instance, a reasonable amount of evidence needs to be collected. Insurance provider policyholders require to be mindful that they do not miss out on any type of vital evidence which they receive all the negotiation amounts they are worthy of.

Insurance insurance holders should not allow a public insurance insurer to bully them right into going for a reduced settlement amount. In fact, they should ask the general public Insurance coverage Insurance adjuster to specify precisely what the insurance holder needs to submit to the insurer in order to settle the claim. The insurance provider should have the ability to provide the insurance policy holder a detailed list of points that they will certainly be paying for when it comes to an occasion similar to this. The General Public Insurance policy Adjuster ought to additionally be able to supply a detailed list of exactly what the policyholder will certainly be responsible for if the policyholder does not prosper in getting a reasonable settlement.